The Courts

The Supreme Court

Benjamin Freedman, the insider at Versaille, who changed his name from Friedman, was also a successful NY businessman. He claimed in 1961 and 1974 speeches that a faculty wife, who got involved with Woodrow Wilson at Princeton, was trying to shake Woody down. NY lawyer Sam Untermyer came up with $40,000 for her, but in return, was to get the next Supreme Court nomination. Louis Brandeis went on the bench.

Brandeis had helped create the Federal Reserve, and became an active zionist, changing his middle name from David to Dembitz, in honor of his zionist uncle.

The fifth jewish Supreme Court justice was Abe Fortas, who resigned during the early stages of impeachment proceedings, based on a $20,000 per annum bribe from the business of Louis Wolfson’s family. So if Freedman had it right, and we look at the first five jewish Supreme Court justices, the odds are 40% they either went on the bench through extortion, or off the bench for bribery.

That’s a match, with the perceptions of Ford; concerns addressed by Churchill; world chess champion Bobbie Fischer’s statement jews are thieves, etc. (Fischer’s mother was jewish.) Prof Shahak, addressed under Historical Notes, Torah and Talmud, helped pull it together.

Even if Freedman did not have it right, one of five is still a very high ratio.

Thomas Mann, who won the Nobel Prize for Magic Mountain, was a staunch anti-nazi, married to a secular jew. (He later came to Princeton Univ, from Germany) Mann said in his diary “It is no great misfortune … that … the Jewish presence in the judiciary has been ended,” although he worried about his ‘secret, troubling’ thoughts regarding the Jews.” Between Dignity and Despair, Marion Kaplan, Oxford Press 1998, ch 1.

Today, and probably since the 1960’s or before, we see grossly disportionate power in Washington– where district, circuit, and supreme court appointments occur– all for life. Recently near half the senate judiciary committee, which controls “advice and consent” by the senate, and a third of the Supreme Court, with three Ashkenazi jews (Ginsburg, Breyer and Kagan) from 2% or so of the population, without significant differences in objective test scores. (Sotomayor, along with the maiden name of her mother, Baez, are Sephardic jewish names from Portugal and Spain, many of whom migrated to Puerto Rico, so she could be from marranist families as well. That would carry some speculation from what I have, but prior to her appointment, she made several trips to Israel, and has never visited Puerto Rico.)

Why does the major media never address this imbalance? What happened to “political correctness”?

Stop the Plunder in Bankruptcy Court

The concentration in bankruptcy courts is probably greater. And the complaints about corruption are predictable.

- Climate

- Ethnic Backbeat.

- Sample Rulings Leading to Huge Fees.

- What to Do.

A. Climate

A Powerful Chorus

“Bankruptcy judges will come under increasing pressure, and perhaps legal restraint, to police the stripping of the bones of the bankrupt that can follow the assignment of a well-regarded law firm to such a case.” Sol Linowitz, ambassador to the OAS; gen counsel and pres of Xerox; and Carter repr to the middle east, in The Betrayed Profession, Scribner, NY, 1994, with Martin Mayer, p. 46.

Harvard Law Professor Lynn LoPucki, addressing Lehman Brothers reorganization fees going as high as $1.4 billion, said “Its like the guy who robbed the banks, because that’s where the money was.” Bloomberg.com, Oct 23, 08. “As the economy gets worse, the bankruptcy lawyers are charging more.” “It seems that each month one sets a new record…” “Bankruptcy Lawyers Seek $18.50 per Minute.” Updated April 4, 2009. By Jan 30, 2009, firms charging over $1,000/hr, going up at four times the inflation rate. ABA Journal.

“The foxes are guarding the henhouse, because lawyers don’t want to challenge other lawyers’ fees.” Prof Nancy Rapaport, Stanford Law grad and bankruptcy fee expert. “There is a sense of entitlement that a lot of lawyers talk themselves into…,” she says, commenting on the study “Routine Illegality in Bankruptcy Court Fee Practices.”

Her 2010 article, Revisiting Professional Fees in Chapter 11 Cases, was originally titled “Pornographic Overstaffing” (ftnote 11), and lays out various ways the fees are bloated.

“Bankruptcy fees may eventually be challenged on grounds that lawyers are mostly liquidating companies instead of restructuring them,” said Stephen Lubben of Seton Hall School of Law. “There is a limit to how many attorneys can demand these kinds of hourly rates, so long as the credit markets remain tight and Chapter 11 tends to be little more than a glorified liquidation tool.” Bloomberg, id.

“The surprising thing is that the fees are not going up faster because no one is controlling them….” Lopucki, NY Times, Aug 3, 2007 byline, “Big Law Firms Embracing Bankruptcy Practice.” See similar WSJ.com blog, Aug 6, 07, “The Backlash Over Bankruptcy Fees.” “The courts tend to barely reduce fees, even in the face of stiff objections… Its all about reciprocity…” Kirkland and Ellis got over $100 mil in fees in the United Airlines reorganization, and contributed $240,000 to Obama and Clinton alone, in 2008.

In Courting Failure: how competition for big cases is corrupting the bankruptcy courts,U of Mich Press, 2005, Lo Pucki thought larger fees in Delaware and NY contributed to higher failure rates. The Chicago courts and bar raised their fees , to compete. The Volukh Conspiracy, review of Aug, 2005.

Commentators in Overlawyered.com said “If there is any part of our legal system that lawyers engage in self-interested profiteering overseen by weak-willed semi-corrupt judicial officers more commited to lawyer enrichment than the financial health of bankrupt companies, it is the bankruptcy courts.”

And, “the inefficiencies of the bankruptcy court system has a far worse impact on the cost of capital than anything that takes place in securities litigation.”

The bankruptcy panel, at the Dec 13, 07 Indiana State Bar business seminar , also focused on the fact chapter 11’s have become prohibitively expensive, due to the litigation, and no solutions are on deck (Steve Ancel).

Former state bar president Tom Yoder, a bankruptcy specialist, tells a state bar seminar, with some emphasis, the upper courts are “rubber stamping” bankruptcy court opinions. Indiana Law Update, ICLEF, Sept 23, 2009.

Skolnick speaks out

Investigations by Sherman Skolnick, founder of Citizens Committee to Clean Up the Courts, led to resignation of two Illinois Supreme Court Justices. Wikipedia, Sherman Skolnik.

“During his long career of throwing crooked lawyers and judges in jail, Skolnick has been sent to jail himself eight times for contempt of court, each time the judge who put him behind bars eventually spending time in jail himself. ‘That’s a record I an extremely proud to have,’ said Skolnick…” Crime Busting, Judge Busting Tough Chicago Investigator Talks About 40 Years Of Putting Government Crooks Behind Bars, by Greg Szymanski, May 26, 2006.

In The Bankruptcy Bordello, Part 6, Bandits and Bigots, June 10, 2003, Skolnick stated:

“…..in most every major city in a federal district, there is a small group of U.S. Bankruptcy Court Judges, lawyers, assignees, trustees, and auctioneers with Jewish last names, some with Christian first names. In places like Chicago, they operate a corrupt enterprise called “The Club”.

Both debtors and creditors are plundered by such a group, often numbering about thirty or so. Some firms are falsely pushed into the Bankruptcy Court for the purpose of stealing funds and assets. In some instances operatives of Israeli intelligence, The Mossad, either renegades or questionably authorized by the State of Israel, if at all, skim, off some of these stolen treasures to be secretly transmitted supposedly to Tel Aviv. Disputes between the local gang and the Israelis sometimes leads to murders. [View the earlier parts of this website series.]”

Skolnik gave details in parts 1 through 7, many of which involved very large amounts and very high places. If true, they are extremely unsettling.

Skolnick’s claims were sometimes verified, and sometimes not, as reflected in the byline by Josh Noel in the Chicago Tribune May 22, 2006, after his death. He may have protected his sources, such as the lawyers who told him about The Club, and similar cabals in other cities.

(Skolnik’s co-hosted Canadian radio program, Cloak & Dagger, was taken off the air in spite of very high market ratings, after he interviewed a former German defense minister, who said 9/11 was an inside job. Wikipedia, id.)

The Indiana Criminal Justice Institute shows about 4,000 crimes for every 100,000 people, or 4%. In.gov/icji/statistical/statistical analysis center/publications/crime trends. The ratio of bankruptcy judges convicted of felonies arising in the course of their duties, however, is closer to 17% for the southern district, although it was just one judge.

If we compared apples to apples, looking only at work related felonies among the general populace, the disproportion would be much greater.

The problem is unmistakable, and vertically entrenched.

B. Ethnic Backbeat—Where the Big Fees Go

The creditors’ rights bar is heavily jewish. In Surviving the Downturn, JewishJournal.com, July 14, 2009, Tom Tugend points out, quoting jewish lawyers, that “Up until the 1970s, bankruptcy law was as Jewish a profession as kosher butchering…” although somewhat more diffuse now. And the butchering is financial.

The largest atty fee approvals in the southern district of Indiana, in 2006 went to:

Akin Gump $7,843,055 04 -19866

Baker & Daniels $2,956,714 04-19866

Ancel, Gerald $1,580,958 05-70961

Greenebaum Dolll & McDonald $968,659 04-19866

Jenner & Block $907,911 05-12743

Paul Hastings Janofsky $767,832 04-19866

One might also look at the firms in Meritas.org, formerly Commercial Law Affiliates. It is not negative per se, that the commercial law bar is heavily jewish, and it would oversimplify to suggest judaism or crypto-jews have a monopoly on greed or exploitation, for several reasons. However, it is probably nieve, to ignore the ideology or history.

C. Tacks Driving Huge Fees

Some of the 25 paragraphs below are legal shop talk, so readers will vary on how much they follow. However, a person with the ability and experience to understand had a ring side seat, to events which dramatize the out of control climate, addressed by the preeminent commentators above. A layman is likely to get a sense of the pattern.

1. A debtor might file easily confirmable chapter 13 plans, meeting his duty under 11 US Code 1322, but an oversecured creditor contrives a drumbeat of trivial objections. The debtor is expected to cooperate; needs to avoid the legal expense of hassling over plans; and an agreed plan is much better than a forced one. So he withdraws the plans, starting over each time. The court may validate the transparently bad faith creditor strategy, by ignoring the dilemma it imposes on debtor; failing to inquire as to creditor motive; treating the pattern as an excuse for the creditor to run its clock at will, and an excuse for the court ignoring its mandatory duty, to confirm a confirmable plan. Basically, blaming and penalizing debtor, for the creditor’s bad faith strategy, when the debtor has filed confirmable plans, and carefully cooperated, as expected. This practical and in some respects legal duty to cooperate looms larger, when standing your ground with a reasonable adequate protection position, as addressed in paragraph 2 below, leads to an abandonment order.

2. Issuing an abandonment order over adequate protection, when Debtor is reimbursing liability insurance well over the contract amount, along with hazard near the principal balance, with no insurance hearing.

3. Allowing an oversecured creditor to pile on over $200,000 in fees, under a duty of restraint, and in the presence of a $2,500 maximum for debtor’s attorney, for all services. Endless objections to plans; motions to dismiss; 9 hrs filling out a claim form a client could complete in 20 minutes; 4 hours on a reinstatement order that could be one short sentence; 3 lawyers from one firm signing pleadings, etc. Debtor files 2 rule 11 motions, so he can get his work done. Fees nearly wipe out the gross rents, more than doubled by debtor’s extensive rehab of the residential project, doing much of the work himself. A lawyer with 30 years experience in bankruptcy court analogizes the fees to stealing, in open court.

Appendix 6 shows 3 photos at the start of the project, and 3 others when it was near full, at the 2004 dismissal and bar.

4. A trustee fails to object to the bad faith tack, or ruinous fees; tries to block debtor from testifying to the considerable project work he got done, while fighting off the litigation; and falsely accuses him in open court, of concealing income.

5. A court casts aside the compelling pattern for oversecured creditor fees, 5-15% of the arrears, as a “meaningless number;” calls the 18 cases a “small sample”; and says “there is nothing in the record to suggest the sellers did anything to compound the litigation” (Tinder, district judge).

6. A court blocks virtually all cross exam, as to the 2d ½ of the $208,000, and a court on appeal points to trivial brief errors, as a reason to not to review the blocking, or the giant fees at all.

7. Imposing a deadline for sale of two off site tracts 20 months after the chapt 13 filing. Debtor could find no case, where a court had imposed a period under 36 months, except executory contracts or leases. (Debtor still got both sold, however, within 20-21 months).

8. Freezing 100% of off site proceeds.

9. Abandonment and dismissal when installment arrears are virtually in hand, the rehab near complete, and rents more than doubled, 22 months out. Some photos of the complex at purchase, half empty, and at dismissal, near full, are Appendix 6 below.

10. Ordering off site sale proceeds held by the cartel firm, instead of the trustee or clerk, when the cartel client had no right to any of those proceeds, but the cartel firm has run up an obscene fee.

11. Making no effort to protect unsecured creditor rights in off site proceeds, all going instead toward the oversecured creditor fees.

12. Ordering a bar, where the court acknowledges lack of bad faith by Debtor, but says fairness requires turning the largely rehabbed tract back to the slumlords who had trashed it, and letting the cartel member pocket the giant fee. The total fee claimed, near $211,000, is about 84 times that normally allowed for debtor’s attorney, for all services. The guy who largely rehabbed the tract? Riding a bicycle, and living in a friend’s basement. At least five Circuit court cases in that Circuit say the court cannot issue a bar, without bad faith.

13. Declining to look at the endless plan objections, or how debtor responded. (It is not possible to see who was being reasonable, without so doing.)

14. Slapping together a string of irrelevant clichés.

15. Transparently selecting out whatever facts or law support the cartel, ignoring the actual record, along with compelling patterns in the case law.

16 Blaming the result on “lack of experience”, with nothing in the record rebutting Debtor’s considerable experience and skills, in bankruptcy court; the physical work of rehabbing the tract; and the legal work of real estate development. Ignoring the minimal experience of the court or creditors’ counsel with similar cases– even less with the rehab, or business aspects.

17. Gratuitously claiming Debtor failed to understand the law, as a smokescreen for the cartel sidestepping it, to clean out the till.

18. All 8 names of the oversecured creditor lawyers, trustee, and judges in the above example were jewish in Avotaynu.com. Only district judge Tinder was not, but the meeting tapping him for recommendation to the white house as district judge, was held at the oversecured creditor’s law firm.

19. The oversecured creditors’ law firm was the Indpls representative of Meritas (meritas.org), formerly Commercial Law Affiliates. The firm got considerable bad press for exhorbitant fees and expenditures in the trust for Ruth Lilly, who was clinically depressed, after a partner was appointed her personal attorney. Also, for a $75,000 retainer demand for a bench trial, forcing a continuance of the Geist annexation case in 2009. Geist Lawyers Backing Out, Indystar.com, Sept 17, 2008. And in November, 2011, a fee of $100,000 to farmer James Anderson, mostly for a tax shelter, previously red flagged by the IRS. Nov 2, 2011 indystar.com. The case against Krieg De Vault was settled during a jury trial, under a confidentiality agreement. Secretary of State Charlie White, convicted of 6 counts of election fraud in Febr, 2012 (3 set aside on appeal) was of counsel to that firm, prior to his election. The Star is owned by Gannett, which is jewish controlled–and deserves a lot of credit, for exposing problem firms.

20. On the heels of the above chapter 13, debtor was sheriffed out of his home and office by Chase Bank, in a sale secondary to the above chapter 13; when he was current; Chase was not served with summons, and thus had no need to bid; net proceeds were neither expected nor generated; and Chase failed to serve the tenants, to whose rights Chase was subject. Debtor sued Chase for its senseless and destructive foreclosure practices, and the same district judge hit him with $30,000 or so in costs, for so doing.

21. In ruling on a debtor motion for an injunction, judge David Hamilton, said “Let’s talk about scam.” (This phrase was an oral observation from the bench, not part of a formal written entry, but the opponents republished it several times in briefs.) Basically, the guy who pulled rusted waste lines and service panels, sanded floors, set posts, etc–turning a hopeless mess into an anchor for his neighborhood– is accused of scamming Krieg De Vault and the slumlords, after they wiped out most of the rents over two years in fees. See Beyond Chutzpah, below, re victimology as a common smokescreen for the exploitive behavior.

Hamilton had attended heavily jewish Haverford College, and is the nephew of Lee Hamilton, described by Webster Tarpley, summa cum laude, Princeton, in Synthetic Terror, as a well known “go to guy” for a whitewash (pp 51 and 445). Lee Hamilton later disavowed much of the 9/11 commission report, after serving as a front for Zionist Philip Zelikow, the executive director. See the protocols, below. Was it fitting, that Lee Hamilton later headed up the Woodrow Wilson International Center? Is there a parallel between the false flag 9/11 event– manufacturing victimology as a smokescreen for Zionist-imperialist aggression–and the “let’s talk about scam” parry of nephew David– covering for a crypto-jewish law firm, which trashed a struggling neighborhood and stuffed their pockets with record fees, running black letter bankruptcy law in the ditch, as they did so?

22. Legacy institutions of Chase—Chase Manhattan, Manufacturers Hanover, and Chemical (Chase.com, About Us, History of Our Firm)– were in the middle of the financial crisis of the 1990’s, setting up the consensus for “terrorism” embedded in the New American Century manifesto, leading to the 9/11 false flag operation. Synthetic Terror, pp 112-114.

23. Chase paid a record $2 billion toward the Enron settlement, addressed below, in 2005, the same year they forced the writer out of his home and office, when he was current.

24. Another Indianapolis example is the $5 million fee for representing one creditor in the American TransAir reorganization, over trustee objection.

25. Yet another, a $2 mil fee contract, some at $1,000 an hour, for representing Indiana pension funds , in cycling the same few key issues through two or three appeal venues, in the Chrysler bailout. That (or one third) might be a plausible contingent fee for salvaging all or part of the entire loss of $6 mil, or $4.8 mil, depending on how you figure it. But this $2 mil was paid win, lose or draw, for work largely completed within a few months. The state police pension official over the funds was not even informed, that $1,000 an hour was being paid. The official assigned by the Treasurer was jewish, and the firm was White and Case of New York and Miami, front and center for hustling securities frauds when I was in law school, in the 1970’s.

Rubber Stamping by the U.S. Court of Appeals

Does the rubberstamping of bankruptcy court rulings by the district courts, as observed by former Indiana State Bar Assoc president Yoder, stop there? Not according to Judge Richard Posner , who resigned in September, 2017 from the US Court of Appeals for the 7th Circuit, over treatment of pro se ( unlawyered) litigants, and his plan to help them.

Valedictorian at Harvard law, the 78 year old Posner is described by the Washington Post as “the most influential lower court judge of the last several decades” and “perhaps the greatest legal scholar of his era.”

In tandem with quitting, Posner wrote a book, Reforming the Federal Judiciary. A key refrain was “rubberstamping” of pro se cases. Those are handled by staff attorneys, who come to the court fresh out of law school, and are gone in two years. Posner says the “staff attorneys” have little contact with the judges, unlike the “clerks, ” who work with them daily. Typically, a stack of files with the staff attorney’s proposed orders or recommendations are brought to the judges, usually three of them, who (on paper) decide the case. This often occurs on a Friday afternoon. Posner says he and the other judges quite often just sign them.

Cases in which both sides hire a lawyer are routinely are set for oral argument, and pro se cases routinely are not. If I had been the anchor man at a correspondence law school, there for a client– oral argument. Only 5 law schools have higher median LSAT’s than Duke; I had over 30 years experience, in and out of bankruptcy court; and had lived with the facts and law of the case for years. No oral argument.

Posner says the the judges’ disdain for pro se litigants is driven by two factors–first, an assumption that if the party had a good case, he could hire a lawyer, and second, implicit bias against people in jail. He says pro se ligitants are disliked as inferiors, based on these factors. He says he had no sympathy for them during his first 25 or 30 years on the bench, after his appointment in 1981. Bear in mind, he reports that about half the appellants are pro se, and half of those in turn are criminal cases.

Posner’s recommended reform #7 is to quit rubber stamping pro se staff opinions. Supervising staff attys have plenty of time to review staff atty work, he says, but apparently do not.

Note that Posner is ethnically jewish, though not practicing. When my own appeal was decided Aug 31, 2007, at least 3 of the 10 active judges were jewish (add Flaum and Rovner). Posner, Flaum and Evans were the judges on my case (No 07-1042). The law firm that ran their billing clock as hard as they could until they cleaned out the estate, Krieg De Vault, was the Indpls member of Meritas, a network of jewish law firms. Note also the wall of silence I encountered in a long list of potential experts, mostly jewish, for mostly straightforward True/False questions or similar input about chapter 13 law, in the disciplinary action over my flyers, addressed under state courts on this site. Think Law of the Mosser.

It might be good to vet 7th Circuit and other court data, against the concerns of Nobel Prize winning author Thomas Mann about jews in the courts in Germany; Chief Justice Stone about the fraud at Nuremberg; Shahak, Ford and so many others about the double standards; and more recently, Rabbi Ovadia Yosef’s refrain about gentiles as donkeys here to serve jews.

The Enron Class Action Fees

The federal courts let the Lerach law firm collect a $684 million fee from the Enron victims, for $2 million dollars or less of work– maybe a lot less. The SEC and Justice Dept put together the case, under a “beyond a reasonable doubt” standard, and Lerach tagged along. Lerach had about $40 mil from which to reserve or pay current hourly fees, from an early settlement. (As Prof Coffee of Columbia said, the $300 million paid to the SEC shortly after the $40 mil to the class was “an easy decision”).

Meantime, Mr Fastow– the accountant who shifted the conduct from creative accounting to fraud, according to Frontline– got about 6 years. That’s $114 mil of victim funds into the pockets of a jewish law firm, for every year Fastow served. Get em up, move em out! (Lerach himself, a heavy political contributor, was sentenced to prison in 2007 arising from unrelated securities dealings).

One of the three executive committee members along with Ken Lay was Richard Belfer. The exposure of the Belfer family, NY oil investors, was up to $2 billion, and they did lose a lot of money. “Belfer Family is Big Loser in Collapse of Enron Stock”, Wall St Journal Dec 5, 2001. How likely is it that Belfer had no clue of what was going on? Can one of the 3 most powerful people in the company, a Harvard Law graduate, claim ignorance of such as massive and ongoing fraud, as an excuse?

Addressing the board as a whole, a permanent sub-committee on investigations of the US Senate found, at p. 56 of its report, that:

Why did the major media leave Mr Belfer almost completely out of the picture, and the rest of the board to a great extent as well?

A Collapse of Values

A judge who is obsessed or nearly so, with pleasing the cartel, may well combine several abuses in one case–completely bastardizing a reorganization into a giant fee machine, for the human vacuum cleaners in the cartel.

So is this system functioning as a bona fide judicial process, or more of a RICO type conspiracy, to stuff money in the cartel pockets? “The religion of a tribal crime syndicate?” The Jewish Talmud Exposed, Brother Nathanael. “In the most important and fundamental affairs and questions, judges decide as we dictate to them, see matters in the light wherewith we enfold them for the administration of the goyim, of course, through persons who are our tools though we do not appear to have anything in common with them — by newspaper opinion or by other means …. Even senators and the higher administration accept our counsels. The purely brute mind of the GOYIM is incapable of use for analysis and observation, and still more for the foreseeing whither a certain manner of setting a question may tend.” Protocol of the Elders of Zion 15, sec 10. Some validate, some dispute the protocols.

Are the Federal Reserve officials the drivers, controlling the timing of collapses, and the reorganization cartel the shooters or ropers, in the big hunt? Thine eye shall have no pity upon them.

The chorus of complaints about the cartel also forces to the surface, for the good of the order, this question—how many whoppers can a judge tell, in a case which rolls huge piles of money into the pockets of his political friends, and still deny that he is crooked, and should quit? How many people are looking the other way, in how many cases—the way so many officials did for Bernard Madoff, until he pulled the plug on himself?

Are we in the end game of the Franklin Prophesies, with the law mostly window dressing, other than the law of the stranger, and the parallel law of the mosser? Is it déjà vu as to the concerns of Mann, Freedman, Joseph Kennedy and so many others, about 1920’s Germany, after jews manipulated WW I and flooded Versaille? Is jewish domination in America now any less than Gemany then?

D. What to Do About Reorganizations

1. Shift to Government Agency.As one commentator said on Overlawyered.com:

“You are in a government-legislator- and judicial-buddies-enabled industry which needs to be shut down and handed off to a federal agency which simply does the accounting and “creditor compressing” needed to complete a bankruptcy. Seems to me this is not much more complicated than what the IRS does in an audit, and could be done much more cheaply by a similar, simple agency working from a standard set of procedural guidelines. Sorry bankruptcy carcass eaters, you are are long past due to be replaced by a simple set of forms.”

2. Have a rule that one mediator, working alone, tries to hammer out a proposed compromise, hopefully working with in house counsel, before the cartel gets control of the estate, and plunders it. Include incentives to cooperate with the mediation.

3. Push for ruleslocal or better yet, national, for set percentages or flat amounts for different services, such as—

a. a percent of the estate for all services, based on available data (Lubben and Lo Pucki’s tables, for example) to be divided among providers. In other words, a grand total for providers, with the excess charges crammed down among the service providers, instead of taken from the balance of the estate as they trade paper to clean it out?

b. a ceiling for oversecured creditors (normally zero, in the eastern district of Pennsylvania).

c. reversion to the rule of law until recently—ie, fees in bankruptcy court must orient to the distressed environment, rather than leading the charge in ballooning fees.

4. Monitor Judges

This is an economic death struggle, with the cartel as the predators.

The cartel is there all the time, and too often, will prefer bag men on the bench. How many people with mediocre intellects and leadership qualities wind up as bankruptcy judges? What is the real reason that happens? Does anybody except the cartel pay any real attention, to who goes on the bankruptcy bench?

Local organizations, like the Greater Indianapolis Progress Committee, could establish Judicial Performance Evaluations (JPE’s) and committees to handle them. Monitoring and feedback, from outside the legal system. If such organizations merely refer suggestions for JPE’s to the federal bench or Senate, that is a nonstarter.

Should we pick up on Sen. Fulbright, Walts and Mearsheimer, and Richard Perle, and focus on undue influence over the federal courts at large? Mr Yoder claims the rubber stamping is because the district courts “do not like” bankruptcy cases, but is the rubberstamping part of a broader pattern?

5. Shop jurisdictions for the lowest fees, instead of the highest—act for the estate, instead of the providers.

6. Avoiding law firms tied to ideologies which present them as elect, chosen, etc. might be prudent. They are more likely to assume the money should go to them, based on the sense of entitlement. High visibility in news, ratings, or other publications controlled by the same ideologies, may be a clue.

7. Negotiate a set price, for your own lawyer.

8. Take bids, which could be required in larger cases. This could build pressure for cost saving measures, like foreign lawyers.

Why did wholesale movement of blue collar jobs overseas occur, while legal services, though easily portable, never quite get exported, and in fact, hourly and total fees in reorganizations push relentlessly up?

”A Gallup survey from the mid-sixties compared employment patterns among religious groups. There is no reason to think that the findings would be markedly different now. On average, 56% of the national work force did not do manual labor. For Protestants,the figure was 52%; for Catholics, 53%; for nonbelievers,62%; and for Jews, 95%. The last figure seems somewhat high, but close to recent observations. .“Jews and Money: The Myths and the Reality”, Gerald Krefetz, Ticknor & Fields, New Haven and New York, 1982, p. 15.

Update the concerns of Churchill, focused on the so-called “international jews” to the currrent U tube video “Goldman Sachs Betrayal of America”. Freedom to move money around the globe is important, but ethnic patterns, of the type which blew up in 1920’s Germany, can be troublesome. Is there a major ethnic connect between the investments bankers, and the reorganization cartel?

9. Business Associations like the U.S. Chamber of Commerce could set up standards, educate members, or both, to build pressure on lawyers who want business from the members. They have the muscle, and should use it.

Steamrolling Over State and Local

I. Carry Over Litigation

A. Chapter 13 Fees

After the case was back in state court, the trial court blocked meaningful cross exam, as to the $100,000 or so of oversecured creditor fees not addressed by the bankruptcy court, and the state appeals court judge declined to review, based on contrived technicalities.

Your writer has circulated the following flyer content, as to judicial retention.

“Vote No on Judge Barnes

Hoosiers should not be left at the mercy of appeals court judges, who aggressively manufacture reasons to avert review of exorbitant attorney fees– generated by a cabal, which has been corrupt for decades.

I have handled a steady stream of state court appeals for 38 years, and chaired four trial seminars for bar associations…. My torts teacher, George Christie at Duke, wrote the West hornbooks on both jurisprudence and torts.

The corrupt cabal is the reorganization cartel, and the state court case at hand was Dempsey v Carter, Court of Appeals Case No. 49A05-0510-CV-603, which you can google.

Its axiomatic that people doing rehabs in modest neighborhoods should do as much of the work themselves as possible, due to the thin margin. There is no reason to make an exception for the legal work, especially for a lawyer who has a fair amount of experience in bankruptcy court, and is working with a user friendly chapter 13 statute. (If he can run plumbing, drag wire, and dig fence post holes, he can work with a simple statute.) However, judges too often are tempted to “teach the lawyer a lesson,” and will aggressively sidestep black letter law, to do it. Everybody gets trashed—the tenants, the lawyer’s struggling neighborhood, and the parties—except the reorganization cabal, which stuffs its pockets with all time record fees.

Judge Barnes characterized his own confusion over the difference between res judicata and law of the case, as a failure by your writer, and pointed to that, as an excuse not to address the blocking of cross exam, or the size of the fees at all.”

B. Case Against Chase Defendants

The US Court of Appeals sent about half of the case against Chase Bank (Stop the Plunder, Tacks Driving Huge Fees, para. 20-23) back to state court. After the Indiana Court of Appeals ruled in the companion case against the Chase lawyer, your writer circulated the following, in a flyer addressing judicial retention:

“Vote No on Judge Vaidik

When judges aggressively ignore or reconfigure key facts to point to a particular result, that is serious corruption, and the people of Indiana deserve better.

if the nation’s largest bank (Chase) sheriff’s a Hoosier out of his home and office, does it matter—

That the customer was current?

That the bank never was served with summons, and thus had no need to bid to protect its position?

That the seizure had little or no chance of generating significant proceeds, the only legitimate purpose of the seizure?

Or that the building was the customer’s primary and only home?

Judge Vaidik left these facts out of an opinion validating the bank’s actions, in

Dempsey v Belanger, No. 49A04-1104-CT-201.

The bank also failed to serve tenants with the clearly required notice. However, Vaidik assessed fees against the customer for pursuing his inequitable conduct claim.

She also

–said the US Court of Appeals reversed “in very small part”– when it sent half the issues back (p 11)

–treated a motion to reinstate within 7 months of remand as untimely

–treated a statement by a court in an earlier case, that a dismissal had been based on a particular grounds, as a holding that only such grounds were available, an obvious nonsequitur.

–in assessing fees, adopted a federal court finding that it was “nonsensical” to see mortgage language, allowing Chase to intervene “on borrower’s behalf”, as permitting Chase to do so, only when it accomplished something other than senseless destruction. The courts ignored two black letter rules of contract construction—construing against the drafter, and adopting the common meaning of words.

–and emphasized on the first page that the customer was representing himself, which has nothing to do with the merits

Vaidik was an undistinguished student at Valparaiso University School of Law, perennially bouncing around the bottom of law school rankings, until it stopped admitting students beginning in 2018.

A Broader Concern

Chase Bank is part of a cabal, that has near absolute power over America and uses that power to break those who oppose them, which is straight out of Torah. The bank’s head, James Dimon, is from a middle eastern jewish banking family. Chase played a pivotal role in the Enron frauds, paying a $2 bil settlement in 2005, the same year they sheriffed the customer out when he was current.

The prediction of Franklin, along with persons in France, of jews in the counting houses and gentiles in the fields within 200 years, is on track. Franklin’s concerns were based directly on the international money cartel, the U.S. constitution was written to escape. America’s money supply has been controlled by the same cabal, since the federal reserve act of 1913 circumvented the constitution. Franklin’s concerns are reflected in the Protocols of the Elders of Zion, and observations of Henry Ford, Winston Churchill, world chess champion Bobby Fischer, and so many others.

Jewish domination within the beltway, and in the federal courts, forges events over time, from bailouts in NY, to foreclosures in Indiana. See Walts and Mearshiemer, The Israeli Lobby, Senator Fulbright, etc. Visit Gentileassociation.org, select historical notes, and the courts, bringing Torah and Talmud forward to today’s climate. Judge Friedlander signed the Belanger opinion.

You must insist on judges, who can and will stand up to this cabal.”

The assessment of fees argument in the flyer was a little involved. Black letter rules of construction in contract law (1) construe against the drafter, and (2) adopt plain meaning of words. The mortgage allowed Chase to intervene “on borrower’s behalf.” For that phrase to have any meaning, it would at least block Chase from forcing the customer out, when there was virtually no commercial benefit for Chase. A chase official told me prior to my filing the suit, that Chase virtually never forced a current customer out. And yet, the court omits the fact the customer was current from the opinion, and assesses fees and costs.

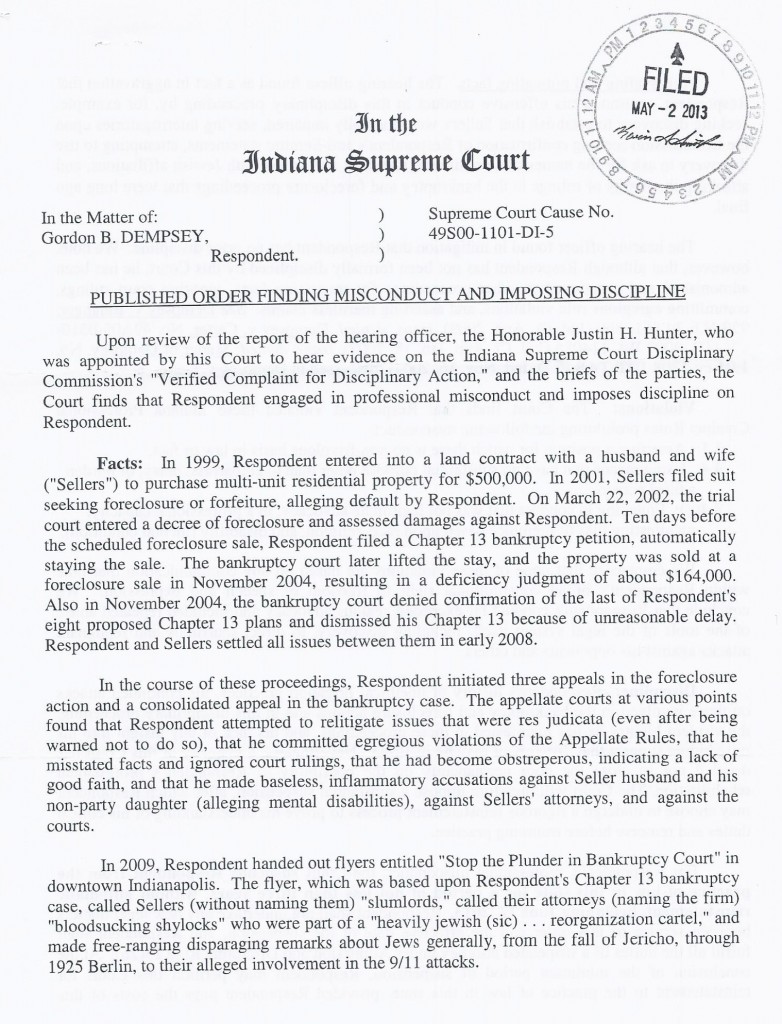

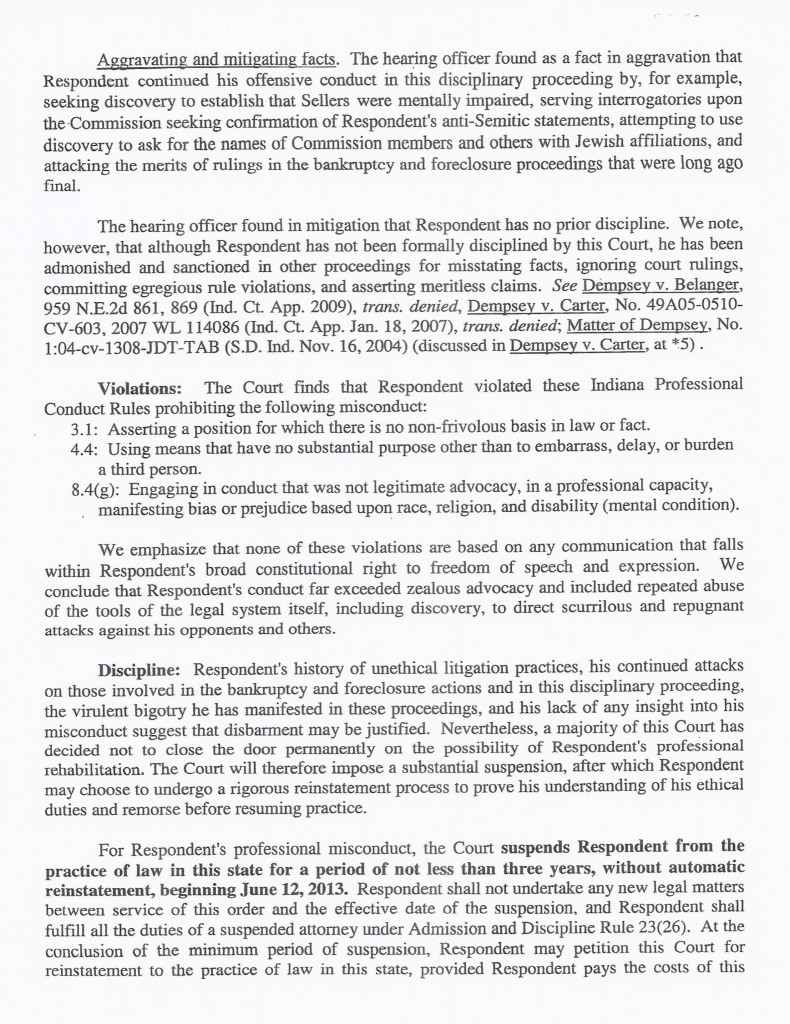

II. Disciplinary Abuses

The master race has control or undue influence over the Indiana Supreme Court disciplinary process. Like the Warren Commission (See Historical Notes/JFK and the Warren Commission para. 27), the 9/11 Commission under Philip Zelikow, and various other examples, they aggressively corrupt when it’s “good for the jews” to do so.

A term like “master race” is not part of the Kool-Aid, ladled out by the major media and much of the government. However, it reflects the explicitly chauvinistic language of torah and Talmud. It also reflects current comments by leading rabbis, deeply admired by hundreds of thousands of Israelis, like Ovadia Yosef, who described the goyim as donkeys, here to serve jews in 2010, after similar comments in 1999. It reflects the equation of Aryan supremacy with judaism in 1937, by Nobel prize winning author George Bernard Shaw, and the description of the doctrine of the Chosen People as religious racism in 1973, by Soviet ambassador to the UN Yakov Malik. It reflects grossly disproportionate power over the courts and other power centers in the U.S., without significant differences in IQ or character.

A jewish law firm and another lawyer cooked up a transparently bogus formal complaint against me in 1995, and got it filed with the Indiana Supreme Court by the disciplinary staff, without considering my prompt response to the show cause. The executive director dismissed it within 22 days on his own motion. However, it still showed up as “concluded discipline” on the disciplinary commission’s website for 17 years, until the site was straightened out. Why did they call it concluded “discipline” when it was dismissed?? A person wanting more detail would have to chase down microfische records, in closed files. How much damage did that do?

Punishing a Snitch

Your writer has appeared in bankruptcy court from to time, from admission to practice in 1974 forward. This included chapter 7s and 11’s, on behalf of debtors and creditors, and adversary proceedings. He had some concerns, about the cartel trading paper until the estates were gone.

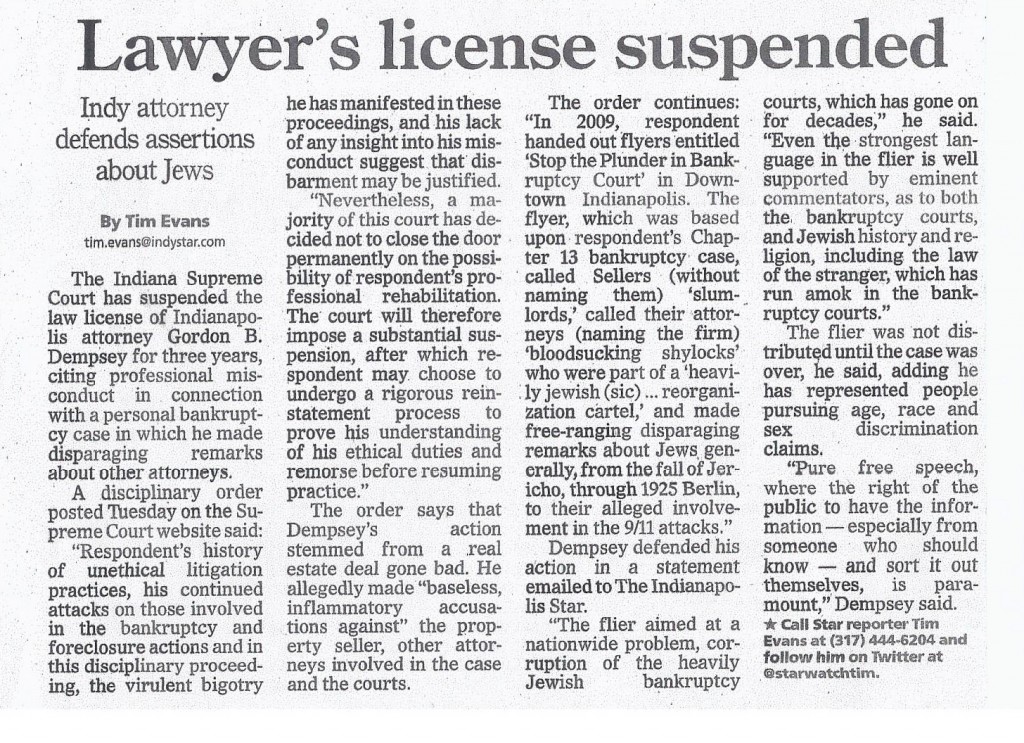

After the local chapter 13 reorganization ran its course, he distributed a flyer in 2009, Stop the Plunder in Bankruptcy Court. (Appendix 1) The flyer relied on nationwide criticism of the cartel by bankruptcy fee experts and other commentators; my own scholarship; and first hand observation. The Supreme Court disciplinary commission wrote to me about the flyer, and deadfiled it in January, 2010.

Several before and after photos of the project are Appendix 6.

In September 2010 I distributed Drydock Mourdock, which took several major state officers to task over excessive fees paid to an out of state law firm, and renewed criticism of the heavily jewish bankruptcy cartel. (Appendix 2)

Here is the T-Shirt I wore while distributing both flyers.

Unbeknown to me, as of the June, 2010 turnover of disciplinary officers, at least half of the 4 executive committee members were jewish, with a jewish law firm or both (Ms Grinsfelder and Ms Zweig) and maybe a 3rd, Mr. Austerman. We also had a Ms Nestrick, with a a jewish law firm, and Mr. Zappia, a question at this point, out of the total of 9 commissioners.

Unbeknown to me, as of the June, 2010 turnover of disciplinary officers, at least half of the 4 executive committee members were jewish, with a jewish law firm or both (Ms Grinsfelder and Ms Zweig) and maybe a 3rd, Mr. Austerman. We also had a Ms Nestrick, with a a jewish law firm, and Mr. Zappia, a question at this point, out of the total of 9 commissioners.

The disciplinary staff officer later told me “The Commission felt I had gone too far”, and in January of 2011, the commission (appointed entirely by the Court) filed a formal disciplinary complaint, based on Stop the Plunder and some 5 year old appeal briefs, which raised exploitive behavior toward their clients by a law firm, mentioned in both flyers. The appeal briefs did not address anything jewish. They did use psychological terms, in an attempt to fathom (1) the grandiose bills, and (2) the apparent exploitation of the firm’s clients, who may have had “diminished capacity. ” Any attempt at “diagnosis” was disavowed.

The complaint said in substance that the flyers and briefs were frivolous, in bad faith, and biased. (Appendix 4)

The strongest language in Stop the Plunder referred to bloodsucking, which wiktionary.org defines as “taking as much as possible from others.” The Oxford English Dictionary defines a bloodsucker as a person who lives off others or extorts, or a parasite.

The evidence of that behavior was overwhelming here, both in the local example and as a long running concern; Jewish domination of the bankruptcy cartel is historic (“as jewish as kosher butchering”, according to a column in Jewishjournal.com); and the exploitive language of Talmud and the old testament is explicit. See deism.com/jewish superiority.

As to currency of the exploitive views, see comments of Sephardic Jewish Leader Rabbi Ovadia Yosef in 1999 and 2010, about the goyim as donkeys here to serve jews. His remarks were condemned, but as many as one fourth (250,000 to 800,000) of the nonsecular jews in Israel attended his 2014 funeral, possibly the greatest ingathering since the Second Temple.

Legal Standard

The burden of proof in an Indiana disciplinary case is clear and convincing, not just a preponderance. Under the First Amendment, speech in a public forum may not be punished without a compelling state interest, and a rule or ordinance must be narrowly written to achieve that interest.

The US Supreme Court has explained that a lawyer may not be punished for speech, that does not present a clear and present danger, or substantial likelihood of material prejudice to a pending proceeding. Gentile v State Bar of Nevada, 501 US 1030, 1039 (1991).

A lawyer’s first amendment rights are less than the general public, only if his speech is likely to impair conflicting constitutional rights of parties in pending proceedings, to a fair trial. ”At the very least, our cases recognize that disciplinary rules governing the legal profession cannot punish activity protected by the First Amendment, and that First Amendment protection survives even when the attorney violates a disciplinary rule he swore to obey when admitted to the practice of law. We have not in recent years accepted our colleagues’ apparent theory that the practice of law brings with it comprehensive restrictions, or that we will defer to professional bodies when those restrictions impinge upon First Amendment freedoms.” Gentile, id, at 1054.

If the lawyer criticizes a public official, he may be punished only if the accuser establishes that the utterance was false, and made with knowledge of its falsity, or in reckless disregard of whether it was false or true. That is true, whether the action against the lawyer is criminal or civil. New York Times v Sullivan, 376 U. S. 279-280, and Garrison v Louisiana, 379 US 64 at 74.

How the Case Went

The Court initially named an of counsel lawyer with Krieg De Vault as the hearing officer! My file marked response was not logged in until I filed a motion 20 days later to compel logging, a first for me.

The new hearing officer, Justin Hunter of Clinton County Superior Court, blocked virtually all discovery, directed at unprivileged communication with the clients, leading to the exorbitant fees. He did so, even though the bankruptcy judge had said the fees were too large, and he did not know why, and reduced them 25%. The hearing officer also blocked discovery regarding the definition of anti-semiticism; any of the scholarship directed at jewish history and religion (“legitimate advocacy”); and how comments after a case was over could be “in a professional capacity” (under Disc Rule 8.4 [g]) when all the Indiana cases to date conformed to the recent pattern in US Supreme Court cases, giving lawyers the same First Amendment rights as anyone else, once a case is over.

Clinton is the only county that touches both a home county of Krieg De Vault (Hamilton) and the home county of the Supreme Court’s disciplinary liasson at the time (Dickson, Tippecanoe), who also wrote the opinion (Appendix 3, p 2) Hunter is another IU-Indpls law graduate, and I have been unable to find undergraduate or law school indicators of relatively strong ability.

As to nonprivileged communication, Krieg De Vault managing partner Hittle explained during deposition of partner Ms Lehman, “This isn’t about what we did. This is about punishing you!” For what? Criticizing what they did, and a value system likely in play.

All discovery aimed at prosecutorial motive (jewish configuration of the commission) was also blocked. Think of the fraud of Nuremberg, so characterized by Chief Justice Harlan Fisk Stone ; aggressive corruption of the Warren Commission’s work by a heavily jewish staff, after assassination of a president, marked by Ben Gurion as a threat to Israel’s survival (JFK page herein); and Abe Fortas’ resignation under pressure. Also, the bogus “formal inquiries” into the 1967 USS Liberty war crimes (USS Liberty page herein); gross corruption of the 9/11 Commission’s work under executive director Zelikow, much of it later recanted by Lee Hamilton and others; blocking discovery and bottling up of first responder Rodriguez’ suit by the federal courts; release of the 5 “dancing Israeli’s” by Zionist US Attorney General Michael Mukasey; and the Guantanamo proceedings, written off essentially as a fraud by 5 chief prosecutors.

Think also, about the tons of evidence and information about all these matters, which the heavily jewish major media has swept under the rug, sometimes for many decades.

Mark Massa, who was general counsel to Governor Daniels when the $2 mil addressed in Drydock Mourdock was paid, and went on the bench in April, 2012, denied a motion to recuse himself.

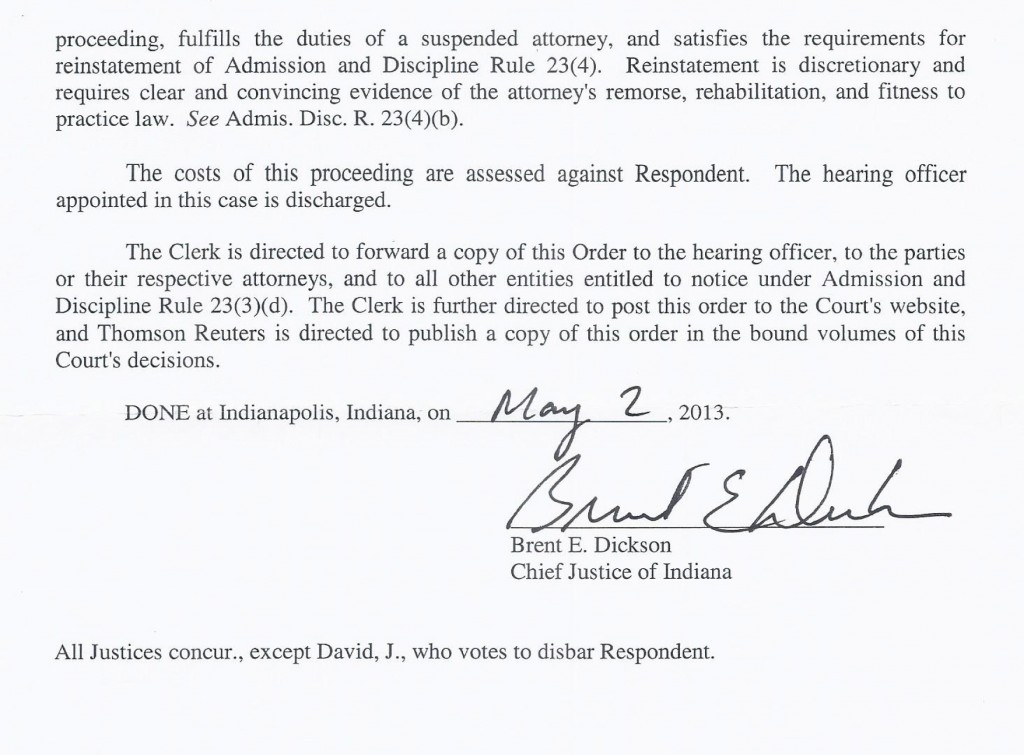

Pointing to no false assertions in the scholarship; refusing to define anti-Semitism (vs legitimate criticism); and denying a First Amendment issue was even in play (note Dickson’s C in constitutional law at Purdue, and his C overall accume, in foundationforlegalreform.org/Indiana Needs a Stronger State Supreme Court ); Dickson decreed “virulent bigotry” and “a history of unethical litigation practices”, and imposed a three year suspension. The May 2, 2013 opinion (App 3) is under cause no. 49S00-1101-DI 5.

This was without automatic reinstatement. That is, come back hat in hand; talk only Newspeak (1984); pay $7,000 or so fees and costs; and we might let you practice law.

The online version of the May 8 article omits all of my observations included in the hard copy, which seems odd, but I have not been able to get an explanation from The Star, in three attempts. Omitting my comments certainly leverages the negative branding, which was intended to result from the prosecution and article.

Note the suspended lawyer (a fiscal conservative) served on the ICLU screening committee (before it became ACLU-Indiana and substituted a screening czar); has represented people pursuing age, race and sex discrimination claims; and served several years as an officer of the Indianapolis Peace and Justice Center.

It may well require several lawyers with strong intellects and experience, willing to put their licenses at risk, to get this problem effectively addressed. The right of the public to hear from those who should know must come first in a democracy.

Additional First Amendment Cites

The Law of the Land

The First Amendment opinions of the U.S. Supreme Court drive home again and again the point of Noam Chomsky, recipient of 39 honorary degrees:

“If we do not believe in freedom of speech for those we despise then we do not believe in it at all.”

“Leafletting and commenting on matters of public concern are classic forms of speech that lie at the heart of the First Amendment.” Rehnquist, J in Schenck v. Pro-Choice Network W. New York, 519 U.S. 357, syllabus.

“…if there is a bedrock principle underlying the First Amendment, it is that the government may not prohibit the expression of an idea, simply because society finds the idea offensive or disagreeable.” Texas v Johnson, 491 US 397, 414 (1989), over the opinion element of burning a flag. In RAV v City of St Paul (1992), the court held a a party burning a cross in someone’s front yard could be charged for arson or criminal trespass, but not for expression of opinion.

“The remedy is more free speech–battling evil counsels with good ones.” Whitney v California, 274 US 357, 375-77 (1927).

Speech “may indeed best serve its high purpose when it induces a condition of unrest, creates dissatisfaction with conditions as they are, or even stirs people to anger.” Terminiello v City of Chicago, 337 US 1, 4 (1949). Terminiello sharply criticized jews before a huge and unruly crowd, but his speech was protected.

Criticizing jews

Terminiello came down within a few years of the notorious American brown shirt endeavor, The Great Sedition Trials. The U.S. Supreme Court made clear the First Amendment protects harsh criticism of any group–even jews! Arthur Terminiello spoke before a large, violent crowd. He said, among other things,

“Didn’t you ever read the Morgenthau plan for the starvation of little babies and pregnant women in Germany? Whatever could a child that is born have to do with Hitler or anyone else at the beginning of the war? Why should every child in Germany today not live to be more than two or three months of age? Because Morgenthau wants it that way, and so did F.D.R (Ed note–Morgenthau wanted to relegate Germany to a permanently agrarian state, and his plan was worth several divisions to the Germans, at the Battle of the Bulge.)….

Now, let me say, I am going to talk about—I almost said, about the Jews. Of course, I would not want to say that. However, I am going to talk about some Jews. I hope that—I am a Christian minister. We must take a Christian attitude. I don’t want you to go from this hall with hatred in your heart for any person, for no person. ..

Now, this danger which we face—let us call them Zionist Jews if you will, let’s call them atheistic, communistic Jewish or Zionist Jews, then let us not fear to condemn them. You remember the Apostles when they went into the upper room after the death of the Master, they went in there, after locking the doors; they closed the windows…..

So, my friends, since we spent much time tonight trying to quiet the howling mob, I am going to bring my thoughts to a conclusion, and the conclusion is this. We must all be like the Apostles before the coming of the Holy Ghost. We must not lock ourselves in an upper room for fear of the Jews. I speak of the Communistic Zionistic Jew, and those are not American Jews. We don’t want them here; we want them to go back where they came from….”

As the court stated, the speaker ” vigorously, if not viciously, criticized various political and racial groups…” but all 9 justices found his speech was protected.

The 4 dissents were all based on failure of the speaker to preserve appealable error in the record, in a case over a small fine. As they pointed out, the court almost never agreed to hear small cases, where no appealable record had been preserved.

One Justice, Jackson, also felt the serious outbreaks of mob violence at the scene constituted the type of “clear and present danger” that warranted a citation. One might note, Jackson was the least educated judge on the court, and the only one who joined the charades at Nuremberg.

Even Jackson acknowledged “any American citizen may go far, in expressing views that are pro- emitic or anti-semitic, pro-negro or anti-negro, pro-Catholic or anti-Catholic… this process of reaching intelligent popular decisions requires free discussion. Hence we should tolerate no law or custom of censorship or suppression” (emphasis ours).

The Great Sedition Trials, the disciplinary order at hand parallels to recent browbeatings by the heavily jewish major “news” media, of people who criticize the “international jews” so sharply condemned by Churchill, and earlier by Franklin. Franklin predicted an American revolution, when the King forced our states and banks back under the yoke of the international financiers, in 1765. There is another parallel to browbeating by the same “news” media of Mel Gibson, for criticizing the role of jews, in triggering wars.

Regarding speech by lawyers, in addition to Gentile, id,

“The First Amendment’s protection of association prohibits a State from excluding a person from a profession or punishing him solely because he is a member of a particular political organization or because he holds certain beliefs. United States v. Robel, 389 U.S. 258, 266, 88 S.Ct. 419, 425, 19 L.Ed.2d 508 (1967); Keyishian v. Board of Regents, 385 U.S. 589, 607, 87 S.Ct. 675, 686, 17 L.Ed.2d 629 (1967).”

The practice of law is not a matter of grace. Baird v. State Bar, 401 US 1, 8 (1971), and Schware v. Bd of Law Examiners, 353 US 232, 239 n. 5.

The Gentile court also stated “If the dangers of (lawyers’) speech arise from its persuasiveness, from their ability to explain judicial proceedings, or from the likelihood the speech will be believed, these are not the sort of dangers that can validate restrictions. The First Amendment does not permit suppression of speech because of its power to command assent.” (p 1056) You can’t punish the lawyer because he is a smart guy, and might be onto something you don’t like. Justice Kennedy pointed out that if anything, the first amendment rights of a lawyer speaking about the legal system should be greater, not less than the general public, because the lawyer is in a position to know. (id, 1056).

If the statements are directed mainly at a judge, though these were not, then in addition to NY Times and Garrison, above-

While the court acknowledged a state interest in protecting the good repute of judges ” like that of all other public officials,” in Landmark Communications, Inc. vs. Virginia, 435 US 829, 840-43 (1978), it found such interest “an insufficient reason for repressing speech that would otherwise be free.” Id, 841-842 Judges should not be “spared the criticism to which in a democracy other public servants are exposed.” Id, 842. “The operations of the courts and the judicial conduct of judges are matters of the utmost public concern.” Id, 838-39. This confirmed the observations in Bridges v. California, 314 US 252, 270-71 (1941), that enforced silence, however limited, solely in the name of preserving the dignity of the bench, was not a good idea. It confirmed the same observation, that judges have no special status, in NY Times v Sullivan, n. 375, pp. 272-73, even in the face of half truths, and misinformation. Statements criticizing judges may not be punished unless “knowingly false, or one made with reckless disregard of the truth.”

The flyers here were directed mainly at an entire cartel, naming a local law firm as an example.

Landmark federal case, when jewish lawyer accused

In a landmark 1995 federal case in California, jewish lawyer Stephen Yagman told people and wrote that a judge was anti-semitic and dishonest, and acknowledged he had no solid basis, but thought accusing the judge of those things would help keep his clients’ cases out of the judge’s court. In a 2-1 opinion written by jewish judge Alex Kozenski of the US Court of Appeals , after an army of jewish lawyers appeared in the case for Yagman, a two year suspension was reversed, because the views of Yagman were opinion, and did not involve false statements of fact. It also pointed out that the burden of proof should not be on the accused, in any event, in accord with NY Times, and the language of Garrison requiring the accuser to establish the charge. Standing Committee on Disclipine v. Yagman, 55 Fed 3d 1430.

What about in Israel?

After the Supreme Court jailed a rabbi’s protégé for bribery, the rabbi said publicly:

“These call themselves the Supreme Court? They’re worthless. They should be put in a bottom court. They, for them [God] created all of the torments in the world. Everything that [the people of] Israel suffer from, is just for these evil people. Empty and reckless… What do they know? One of our children of 7–8 years knows better than they how to learn Torah. These are the people who have been put in the Supreme Court. Who chose them, who made them judges, but the Justice Minister, persecuter and enemy he liked them and he recommended that the President would appoint them as judges. What, were there elections? Who says that the nation wants such judges, such evil [ones]… They have no religion and no law. All of them have sex with Niddot (women who are menstruating). All of them desecrate the Sabbath. These will be our judges? Slaves rule over us.”

The Supreme Court declined to put Yosef on trial, because his comments were within his right to freedom of speech.

Contrast to the case at hand, in which a gifted lawyer with a ring side seat used good scholarship and first hand observations, and directed his concerns primarily at the cartel as a whole.

Expert Witnesses and The Law of the Mosser

I sought out the most knowledgeable experts I could find, and asked each of them to check off yes/no/qualified on a set of mostly straighforward true/false questions, regarding chapter 13 law. Bear in mind, chapter 13 is intended as a user friendly statute, and all or almost all of these could be answered in less than an hour, or a little more if the respondent wanted to elaborate. I told them it was ok if they did not answer all of the questions. I offered to reimburse them at their normal hourly rate (a standard practice for expert witnesses), in advance if preferred.

The survey approach was based on the thought, that a group of top experts confirming points of black letter bankruptcy law would be more persuasive, than “one man’s opinion.” That was especially true, with a hearing officer who repeated that he would not “go behind” the underlying rulings. It also could help drive home the sheer volume of black letter law that was bulldozed aside, like a Palestinian home, until the estate was cleaned out. The survey could be supplemented with case specific testimony, as warranted. The Survey is Appendix 5.

I asked 2 presidents or former presidents of chapter 13 trustee associations, 2 presidents of consumer bankruptcy lawyer associations, one lawyer with a group that advertised as chapter 13 consulting experts, one lawyer who had written a chapter 13 user guide, another who had writtten a bankruptcy text, and several others teaching consumer bankruptcy law, 14 in all. Not one expert answered one T/F question, nor did any offer to review the file and give a more involved or case specific opinion. What I got was a total circling of the wagons, reflecting the pattern addressed by Shahak, Ford, Makow, Skolnick, and in the talmudic language itself.

One facet is the talmudic law of the mosser. Report a jew, and rot in hell. See Rabbi Broyde, Halakic prohibition that a Jew cannot inform on another Jew. In the context at hand, cooperating with me would help expose the exploitive behavior, by this law firm which is the local representative of Meritas. Even if all the lawyers in the cartel are not jewish, which is true, the culture settles in.

Observations

Compare the Great Sedition Trial of 1944 in Washington, DC and the earlier Soviet antecedents, addressed in this site under Historical Notes, Early Twentieth Century, just before the JFK material.

Our freedoms– to candidly criticize and protect ourselves from chauvinistic and exploitive ideologies–are disappearing.

In the five year old appeal briefs, I mainly asked questions attempting to sort out how the lawyers could have run up such an exorbitant bill. The discussion of behavior that tended to point to clinical vulnerabilities– used as a frame of reference and disclaiming any attempt at a “diagnosis”–fell well within the rules, guidelines and case law, regarding the duties of lawyers toward potentially vulnerable clients. I also correlated grandiose statements by the lawyer, with the grandiose bill.

Most of the Indiana Supreme Court judges are profiled at foundationforlegalreform.org/Indiana Needs a Stronger State Supreme Court. The people of Indiana would be better served, by a more gifted group at the apex of their legal system.

Judge David, who voted for disbarment, was probably immersed in zionist/imperialist dogma, during his time at Guantanamo. He authored a decision advancing long term Zionist interests, and they manipulated the retention process following that, in his favor. See Foundationforlegalreform.org/Zionist Manipulation of a Retention System

Appendix 1

Stop the Plunder In Bankruptcy Court

Reorganizations loom large in a pattern of plunder, evident in the U.S. today.

“Stripping of the bone” of debtor estates, when highly political law firms show up. The Betrayed Profession, Ambassador Sol Linowitz, 1994, p 46. “Its like the guy who robbed the banks, because that’s where the money was.” Prof Lynn Lo Pucki, teaching at Harvard Law in the fall, Bloomberg. “A glorified liquidation tool.” Prof Stephen Lubbens, Bloomberg. “The foxes are guarding the henhouse, because lawyers don’t want to challenge other lawyers’ fees.” Prof Nancy Rapaport, Stanford Law grad. “There is a sense of entitlement that a lot of lawyers talk themselves into…,” she says, commenting on the study “Routine Illegality in Bankruptcy Court Fee Practices.”

A flagrant local example is Krieg De Vault–Indpls representative of the Commercial Law League [ed note–wrong former name] now Meritas.

Krieg De Vault ran up a bill over $200,000, for an oversecured creditor in a chapter 13– where the maximum fee allowed, for all services of a debtor’s attorney, was $2,500, absent extraordinary circumstances. This was under a clear legal duty of oversecured creditors, to show restraint. Nine hours on a claim form the party could do in 20 minutes, 4 hours on a reinstatement order that could be one sentence, 3 lawyers signing pleadings, multiple lawyers at plan hearings, lengthy phone conferences, etc.

The case involved a neighborhood rehab. The person doing most of the hard work, with considerable skill, filed easily confirmable plans; virtually completed the project; and had the installment arrears virtually in hand; within less than 2 years–in spite of Krieg De Vault’s utterly uncontrolled, scoff law litigation.

The slumlords (like Kreig De Vault’s clients) and derelict tenants pale compared to the reorganization cartel, as bloodsuckers.

This cartel is heavily jewish. The lore mentions cultivating vulnerable goy into power– someone who looks like “one of them,” but is really more often than not, a foil. One cannot help but suspect that strategy, in selecting bankruptcy and other federal officials– and thus, in the pattern of free plunder. Protecting the public demands a major, concerted effort. One might connect dots from—

The History. Jericho, the fate of the Midianites, the supremacist dogma of torah, early Talmud, classical exploitation of the goy, fears during the enlightenment, the Sept 3, 1882 Russian edict, dominant role in the Bolsheviks, and concerns of Voltaire, Churchill, Thomas Mann, Joseph Kennedy, Ford, probably Edison, Benjamin Freedman, Solzhenitsyn, and so many other keen minds.

The Power Structure. Control of the money supply from the top; control of major news and entertainment; undue influence in foreign policy and Congress; and the ability to corrupt the courts, as examples. Half the partners in big DC law firms are jewish, like lawyers and physicians in 1925 Berlin, from under 2-3% of the population, with equivalent intelligence. America, as a faux republic?

Corrosive Events. Instant massive bailouts of wealthy bankers, after reckless investments; huge securities frauds, which regulators ignore ; sharp credit card tactics; uncontrolled reorganization fees; strong evidence of 9/11 as a zionist false flag operation—which the media also ignores.

In Beyond Chutzpah, Norman Finkelstein, PhD Princeton, discusses the mindset of jewish superiority, arising from economic and political power, and leading to reckless and ruthless conduct. He says these jewish elites need to be stopped. The bankruptcy cartel, including its gentile foils in the federal system, is one of the worst examples.

Gordon Dempsey

See foundationforlegalreform.org., still in rough form, for more detail, and solutions.

Your writer scored 138 on nat merit, 3 pts from the cutoff, qualified for debate nationals, and attended Wabash on a full tuition Baker. He held some leadership roles, and turned in a higher GPA than each of his 5 classmates or fraternity brothers, who are partners or counsel at Baker & Daniels or Ice Miller. He passed the written and oral for the U.S. foreign service, and attended a top 10 law school (like maybe 3 of over 100 lawyers, at Krieg De Vault).

Let’s bring this “stripping of the bone” to a halt! By bloodsucking shylocks, like Krack De Vault! And give America a much better deal, than the public officials who help them steal.

Appendix 2

I ask fellow Republicans and others, to vote for young Rhodes Scholar PeteButtigieg (Democrat) for Treasurer.

Richard Mourdock helped his cabal plunder nearly $2 million from three pension funds, for over the top legal fees in the Chrysler bailout appeal.

The appeals cycled the same two or three issues through two federal courts, plus an attempt at Supreme Court review. There are only so many ways, a lawyer can knaw on the same shoe.

Its rare for a lawyer to spend more than a week, briefing an appeal. More likely, a few days. If you can’t figure it out and say it in a week, its probably a dog, as these appeals were.

Even if three lawyers worked a week, at an average of $250/hr, six billable hours a day, that’s about $22,500 for the first, substantive appeal. There is no valid reason for the refinements, in recycling the issues at the next level, to take longer, and they normally go quicker.

So any keen minded and diligent bankruptcy or federal appeals lawyer, or small team, should have been able to lay out the issues for under $100,000– possibly well under– through the petition for Supreme Court review.

The real problem? The bankruptcy cartel, which happens to be heavily crypto-jewish, is full of thievery and corruption. Mourdock’s crowd tapped into that. White and Case, the NY/Miami law firm that did the $2 mil contract, was front and center for hustling securities frauds, when I was in law school in the 1970’s.

Former chairman and genl counsel of Xerox, Ambassador Sol Linowitz, said in The Betrayed Profession that legislation may well be necessary, to stop the “stripping of the bone” in reorganizations. Harvard bankruptcy law prof Lynn Lo Pucki says the emerging $1,000/hr fees “are like the guy who robbed the banks, because that’s where the money was.” White and Case the Joint billed those amts here.

The contract states on p 1 “The firm retained for this case is the only firm in the country that was in a position to perform this representation on such a time frame.” With all the constitutional and bankruptcy expertise in Indiana alone, and the flat demand for lawyers, what a whopper!

Note, the $2 mil would be the 1/3 contingent fee, for recovering the entire $6 mil lost (at 29 cents a share in the deal, vs the 43 cents Mourlock paid for the junk bonds.)

In the debates, Mourdock stresses “Constitutional rights.” (My con law teacher, in a group of 20 or so students, later served as acting US Solicitor General.) It required nowhere near $2 mil of lawyering , to state and cycle these few constitutional and bankruptcy issues.

The Zionist major media will cover for Mourdock, seen as one of theirs. Also, to keep the governor, who approved the startling heist, lined up for the Big Dance.

Kirkland & Ellis piled on over $100 mil in fees, in United Airlines. Akin Gump, $5 mil representing one creditor in American TransAir, over trustee objection. Krack DeVault, the law firm of a sibling of the governor, piled on over $200,000 fees acting for oversecured slumlords in a chapter 13– devastating my neighborhood, their client, and the debtor—everyone but them. Countless other examples. Franklin Prophesies, within 200 years, jews in the counting houses and gentiles in the fields. Are we on track? About half the Senate Judiciary Committee, half the partners in the big DC law firms, a third of the Supreme Court. Two or three percent of the population, with roughly comparable IQ’s. See Walts and Mearsheimer, The Lobby. Shahak, Jewish History, Jewish Religion.

The broad jewish community should help bounce Mourdock. He and his crowd do too much damage, lending credibility to the claim of jewish world chess champion Bobbie Fischer, and others, that jews are thieves, and the like.

Gordon B. Dempsey

This flyer a joint project of Foundation for Legal Reform LLC, PO Box 22542, Indpls, IN 46222 and Gentile Assoc, Inc, all the same dude. Raised in Haughville, lives there now. But showed more skill as a debater, and trained at a more selective law school, than the governor. Lot of securities, bankruptcy, and federal appeals experience.

Appendix 3

Appendix 4

Appendix 5

Appendix 5

Questions

Set forth below is a set of propositions under bankruptcy law, involving a single asset chapter 13, oversecured.

Please write T for true, or F for false. Then B for blackletter; G for generally; or O for occasionally. Feel free to comment.

Proposition

- The purpose of Chapt 13 is to provide time for debtor to rehabilitate.

2. The debtor’s duty is to file a confirmable plan, not to confirm it. 11 U.S. Code 1321, 1322.

3. The court has a mandatory duty, to confirm a confirmable plan. 1325.

4. A competent bankruptcy lawye would not argue a chapt 13 debtor failed to meet his duty to “confirm a plan.”

5. Chapter 13 is a simple, user friendly tatute—“…a flexible vehicle. Section 1322 emphasizes that purpose by fixing a minimum of mandatory plan provisions, “ (Senate Report 95-989), requiring no lawyer at all, to prepare a plan.

6. If a debtor files easily confirmable plans; gets a rehab largely complete and nearly full; and the installment arrears basically in hand; all within two years of filing; it would be almost unheard of,for an oversecured chapt 13 creditor to pile up $200,000 in atty fees, and obtain a dismissal and bar.

7. This would be particularly startling,where debtor built rents up from $4,600 to over $11,000 per month, and the oversecured creditor attorney fees wiped out those gross rents, for the duration of the plan.

8. “Nothing we do is boilerplate,” when asserted by oversecured creditor’s counsel, grates against the letter and spirit of chapter 13.

9. 11 USC 506 (b) is the correct cited for oversecured creditors seeking fees,rather than 506 (c).

10. In a single asset case, normally the arrears, rather than the entire contract, are paid under the plan.

11. Smaller real estate rehabs do not normally contemplate passing out a lot of retail checks to contractors, lawyers and the like, due to the narrow margin.

12. It is a bad faith strategy, for an oversecured creditor to bury a debtor, in pointless, trivial plan objections.

13. With oversecured creditors showing the required restraint, little lawyering should be required of debtor to deal with them, pro se or not.

14. Debtors should try to cooperate with oversecured creditors where possible,as to plan objections.

15. Debtors are better off with a plan approved by oversecured creditors, rather than ordered over their objection.

16. If a debtor is faced with a drumbeat of objections by an oversecured creditor to each plan filed, it is a reasonable response by debtor to make sure he is filing confirmable plans, and cooperate fully as to the objections.

17. If an oversecured creditor persists in such a tack, the judge should ask them why they are doing it; instruct them to stop; or both.

18. A good bankruptcy lawyer would not respond to Colliers’ citations by pointing out the editor, “Larry”, just publishes what he wants the law to be, and if opposing counsel wants to know what the law is, he should ask that lawyer.

19. Normally a secured creditor does not demand an increased interest rate; short-ened default period from 30 to 10 days; automatic inclusion of post petition fees; agreement in advance to a bar if dismissal occurs; or automatic default in 10 days, as to any lien; as a condition to the chapt 13.

20. An Indiana bankruptcy lawyer will not normally seek judgment interest rate in a plan, if the contract provides a rate.

21. A debtor is required to make the first creditor payment within 30 days of filing the initial plan, but not a payment to every creditor.

22. Debtors may secure unsecured creditors in their plans, but not better than secured ones.

23. If a state appeals court orders the oversecured creditor to file its answer brief, in an underlying appeal, most oversecured creditors would sign an agreed entry for lift of stay to file the brief, instead of insisting on a formal motion and hearing, in the absence of significant basis to contest the appeals court order

24. If debtor is reimbursing the oversecured creditor for casualty and liability insurance,at the time of chapter 13 filing, the oversecured creditor needs to object to the insurance arrangement in responding to the plan, or seek court approval to abandon the coverage, instead of keeping the premiums,and cancelling coverage.

25. A party claiming it is paying unreimbursed insurance should not block two simple interrogatories, directed at documenting that point.

26. Oversecured creditors may require debtors to insure property for the amount owed, and sometimes for its value; but not for future appreciation; attorney fees; or debtor’s equity.

27. An oversecured creditor should not seek abandonment, based on failure to insure future appreciation, attorney fees, or debtor’s equity. At most, it should ask for a hearing to argue for those.

28 . Creditors are required to immediately mail written notice and/or give oral notice, of an ex parte abandonment order, partly due to the 10 day appeal deadline.

29. Oversecured creditors are required to show restraint, in their billing.

30. Three lawyers signing pleadings is not normal, in a chapter 13.

31 . Multiple lawyers at hearings for an oversecured chapt 13 creditor, would not be normal, though foreclosure counsel might be present, on occasion.

32. Lumped, huge bills are not acceptable for oversecured creditors, in such cases.

33. Nine billable hours is almost surely excessive, for completing a claim form.

34 . A party does not normally need a lawyer, to fill out a claim form.

35. Almost all reorganizations have at least a few, of the numerous indicia for bad faith filing.

36. The presence of one or two such indicia, therefore, does not normally justify a motion to dismiss for bad faith filing.

37. If a creditor needs a firm date by which off site realty will be sold, a letter requesting such a date should be used, rather than a motion to dismiss.

38. An oversecured creditor should not file a motion for abandonment, based on circumstances which have little or no chance, of threatening feasibility.